Overview of Cement & Concrete

Cement is one of the key ingredients for making concrete. Concrete is composed of 10% cement, 20% air / water, 30% sand and 40% gravel. This is an important distinction to make, notably that cement is just one of the ingredients of concrete but a vital ingredient.

Concrete is abundantly used in the world and arguably the most abundantly used man made material on the planet. Concrete has been in use for a long time and the Romans have used concrete in their structures although modern concrete production methods differ from antiquity methods.

Modern cement manufacturing commenced in 1824 and is called Portland Cement which is still the predominant approach to cement manufacturing. Whilst western nations used concrete extensively in the 20th century, China since the turn of the millennium has used more concrete than what the US poured in the entire 20th century. This shows the integral nature and importance of concrete when it comes to our modern societies and development.

Concrete is preferred for under water construction projects. This is because concrete is both fire and water resistant which is one of the key appealing features of concrete. Concrete is used extensively for both residential and commercial construction, infrastructure projects, bridges, roads, dams etc. Concrete has very high compressive strength as well. The largest concrete structure in the world is located in China, the 3 gorges dam which is 185 metres high and 2300 metres long!

Cement Production Snapshot

In 1970, world cement production stood at 594 million tons. By the year 2020, world cement production stood at 4.1 billion tons! Compare the growth of cement with steel which we analysed in part B. Steel grew from 595 million tons in 1970 to 1.8 billion tons by 2020. This shows whilst steel has been growing at an immensely fast rate, cement has out stripped steel. In fact cement production has been above 4 billion tons per annum since 2014.

Source: Statista

Again China is the dominant cement producing nation having produced nearly 2.2 billion tons of cement (source statista) in 2020 which means 50% of world cement production is based in China. Unlike steel or petrochemicals, both which are extensively traded, cement is hardly traded and is consumed in the country of production itself. After China, the next biggest cement producer is India standing at around 340 million tons.

Source: statista

Cement projections by the IEA hold cement production above the 4 billion per annum mark into 2030 and even into 2050. This is because countries are still increasingly consuming cement to develop infrastructure, roads, buildings etc. The integral nature of cement ensures that cement production is unlikely to sharply taper of in the future.

In the business as usual case the IEA projects that cement production will trend towards the 5 billion tons per annum mark. However, in a more balanced scenario (Sustainable Development Scenario) because of material efficiency gains, cement production will fall by 2070 to around 3.5 billion tons. Material efficiency can come about by extending the lives of buildings, repair rather than rebuilding, onsite waste reduction and design optimisation.

Already developed countries are seeing cement demand flat to falling as most of the demand is for maintenance rather than new builds. There is also a degree of saturation being observed in China with respect to cement demand. However, this will be counter balanced by India and other emerging economies are expected to increase their demand for cement in the future.

Cement - Energy consumption and CO2 emissions

Cement production is highly energy intensive. Around 2.8 GJ of energy is needed to produce 1 ton of cement which translates into around 10.7 exajoules per annum of energy consumption for the industry. Energy costs account for around 15% to 40% of total product costs as per the IEA. Coal is the dominant energy source for the industry and fossil fuel provides around 60%-70% of the total energy needs for cement production.

On the emissions front producing 1 ton of cement generates 0.5-0.6 tons of CO2. Compare this is to steel via the blast furnace route which will produce nearly 2 tons of CO2. Hence, cement is not as CO2 intensive as steel but is still quite intensive. In 2019, the cement industry worldwide emitted 2.4 billion tons of CO2 which meant cement contributed to around 7% of global CO2 emissions.

Importantly, nearly two thirds of the emissions from the cement industry are process emissions which is a stark contrast to the steel industry where bulk of the emissions result from fuel combustion.

Cement Production Method

Unlike steel where there are quite a few methods of production, for Portland Cement it is essentially one and has remained unchanged for around 200 years or so. Limestone (CaCO3) is the prime feedstock for cement. Limestone is heated to around 1500C to 2000C in a rotary kiln in the presence of other additives like quartz, clay etc. Simplistically, CaCO3 under the application of heat becomes CaO (clinker) and CO2.

This shows that CO2 emissions are fundamentally linked to the production process of cement itself and is a very important concept to remember.

Clinker is then mixed with gypsum to form cement.

The videos below show how cement is made.

https://www.cement.org/cement-concrete/how-cement-is-made

https://www.youtube.com/watch?v=TdxPxfeEUSQ

Cement is then mixed with water/air, sand and gravel to form concrete which is the final building block material. There is a link below to more details around the production of concrete from cement.

https://www.cement.org/cement-concrete/how-concrete-is-made

Cement production challenges

1. Process emissions : around two thirds of the CO2 emissions from cement manufacturing comes from the process itself. Application of heat to lime to produce clinker results in CO2 emissions. Unless there are alternative materials to clinker, CO2 emissions will continue to take place during the production of cement.

2. Fossil fuel for combustion: cement kilns need to be heated to 1500C -2000C. Fossil fuel is primarily used for this purpose and within the fossil fuel category it is coal that dominates usage in the cement industry (50% or so). Given the high temperature requirements for the process and kiln design, fuel switching or electrification is not a very easy option.

3. Regional industry: unlike steel and chemicals which are global industries whose products are shipped across the world, cement is a very regional industry. Cement plants are established close to raw material centres or end user demand centres. This implies that cement plants will tend to use more locally available energy sources rather than the most environmentally friendly options. Also given the product is not traded over long distances and there is no ready substitute product for cement provides little incentive to the manufacturers to change their fuel mix or consider carbon capture technologies.

4. Age of asset life - cement plants have an average life of around 40 years since commissioning. Most of the cement capacity in the recent past has been added in the Asia Pac region and the average age of these plants is below 15 years. With high capex costs needed to establish new cement kilns, it is not possible to prematurely retire existing plants and replace them with new cement plants that emit low CO2. Therefore retrofitting existing cement plants is critical.

source IEA.

5. Indispensable nature of the industry: there are very limited / no alternatives to cement at the moment. Consumption of cement & concrete has only been rising. As countries continue to urbanise and invest in infrastructure and buildings, demand for cement will continue. Cement being largely water and fire proof as a material also makes it very attractive. In addition, the building block for cement is limestone which is abundantly available, making it a preferable choice for all countries.

Route to decarbonisation

The route to decarbonisation for the cement industry must start with appreciating the key fact that two thirds of the cement sector's emissions are process emissions.

There are two key strategies needed in addition to the material efficiency already discussed in the section around Cement Production Snapshot.

A. Clinker to Cement Ratio : there needs to be a fall in the clinker to cement ratio. By reducing clinker and increasing other less CO2 intensive additives into cement the overall CO2 intensity of cement will reduce. Substitutes for clinker include fly ash (from coal fired power plants) or slag (steel production). However, both these two should also decrease as we speed up decarbonisation in general. Other naturally occurring substances that could be used include clay, gypsum, limestone.

Clinker to cement ratio however has been inching up and reached 72% in 2020 as per the IEA. In IEA's net zero 2050 scenario, clinker to cement ratio must fall to 0.65 by 2030. There are limitations here with respect to how much adjustments can be made to this ratio as cement composition is a highly regulated and safety considerations are paramount. Further, China the world's largest cement manufacturing nation has one of the lowest clinker to cement ratios already.

B. Carbon Capture Utilisation and Storage (CCUS) : This is the key carbon reducing solution that is prescribed for the cement industry. This is projected to account for nearly 60% of the reduction of cumulative emissions of the cement industry. Note since process emissions are key in cement, carbon capture takes a pivotal slot. CCUS uptake will increase after 2030 by which the hope is for CCUS costs to fall considerably. The IEA projects nearly one cement plant per week of 2 mtpa capacity being fitted or retrofitted with CCUS from 2030 to 2070 and cumulative CO2 capture target of 40 billion tons!

Other considerations include:

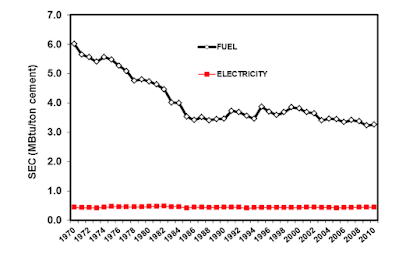

Technological improvements : Expected to be limited as the two main cement producing regions China and India already employ dry kilns with a pre calciner which is the most updated cement producing technology. Energy intensity in the cement industry as shown in the graph below has already been falling over the past few decades hence greater improvements in this regard could be minimal.

Fuel Switching: The prime fuel for the cement industry is coal. A switch to a lower CO2 intensive fuel such as natural gas, bio fuels and hydrogen is a possibility to reduce CO2 emissions. As temperature requirements for a kiln are high, the ability to switch to electricity is very limited. Given CCUS is the prime strategy to reduce CO2 emissions, more gains can be made by switching from coal to natural gas than say bio fuels as bio fuel sourcing is already constrained in the global system.

Hydrogen: Hydrogen use is likely to be limited in the cement industry's transition. This is because considerable capex has to be spent to reconfigure a kiln if hydrogen as a fuel is used. Hydrogen is more likely to be used as a blend along with natural gas rather than 100% standalone hydrogen. Hydrogen requires cement burners etc to be re-designed and new coatings to be applied inside kilns etc which makes it very expensive

In the IEA net zero scenario for cement, coal use is eliminated completely by 2050. Natural gas replaces coal with a energy share of 40% (up from its current 15%), biomass and renewables at 35% (up from its current 5%), hydrogen, direct electrification, oil, others etc is the balance. Hydrogen would be around 10% of the thermal energy by 2040.

Recent Initiatives in Decarbonising Cement

As CCUS is the key technology to decarbonise cement manufacturing, lets look at a few projects (links to relevant videos are provided for additional context) currently ongoing that might prove critical and positive towards decarbonising cement.

Anuhi Conch Cement is the largest cement company in China and has a clinker production capacity of 260 million tons. Anuhi has invested around $10mm in a CCUS facility for one of its plants that will separate and purify 50,000 tons of CO2 per annum.

Norcem the Norwegian cement manufacturer is also looking at a CCUS project. It has successfully completed a feasibility study, and is now looking to scale it up to industrial levels. https://www.youtube.com/watch?v=1dv38NhUyoE

Pilot scale project has been successfully completed by CEMCAP in Germany for carbon capture. https://www.youtube.com/watch?v=QSmEJgVKz-A